We reviewed twenty five companies to develop this checklist of the greatest wealth management firms. The ones that didn’t make the Lower fell shorter on characteristics most clients want.

Modifications in real-estate values or economic disorders may have a good or negative impact on issuers from the property field.

Fidelity's Virtual Assistant works by using advanced technological innovation and artificial intelligence to aid with often requested inquiries and also to enhance your digital encounter. It is designed to be both of those anticipatory and responsive based upon your search conditions, facts you enter in reply to your Digital Assistant's issues, and your account as well as other information on file with Fidelity. Fidelity does not ensure accuracy on the Virtual Assistant's responses or alignment of its tips with your supposed objective. The Digital Assistant won't suggest the acquisition or sale of certain securities or digital assets. Although it may well provide instructional info, it does not have the aptitude to discern what investment decisions might be well suited for your own problem.

Consent is not really a problem of obtain or of participation in promotional or price cut plans. Message and Knowledge prices could implement. Message frequency may differ and could occur from distinct telephone numbers. Chances are you'll opt from getting these text messages at any time by texting Halt. Privateness Statement. Rev nine/2024.

Small entrepreneurs often Assume they can’t afford to offer a 401(k) plan. We can help you find a plan that allows your staff to accomplish their retirement objectives whilst putting tax savings with your pocket.

Wealth management firms can also offer specialised services for certain teams. As an example, some firms perform with Skilled athletes or business executives.

Asset allocation funds For traders who haven't got some time or the skills to make a diversified portfolio, asset allocation funds can function a powerful one-fund strategy. Fidelity manages quite a few differing kinds of these funds, which includes funds which can be managed to a selected goal day, funds which might be managed to keep up a certain asset allocation, funds that are managed to produce income, and funds that happen to be managed in anticipation of certain outcomes, such as inflation.

At that point, Microsoft Promotion will use your complete IP deal with and consumer-agent string so that it could thoroughly process the ad simply click and charge the advertiser.

Will not attempt to position trade orders through the Virtual Assistant; it can provide you with assistance as to how to put a trade at Fidelity, even so the Virtual Assistant cannot execute trades on your own behalf. Any personal, account or other details you provide on the Virtual Assistant, as well as all look for facts entered, could possibly be retained, accessible to Fidelity staff, and made use of and shared constant with Fidelity's Privacy Plan. Notwithstanding, you shouldn't present Tax-advantaged retirement accounts the Digital Assistant with credit rating or debit card facts or secured wellbeing information. Method availability and response periods might be subject matter to market conditions.

The firm has thirteen,000 advisors, this means you’re more likely to locate a fantastic in shape. It also offers services positive to fulfill each and every investor’s requires. These involve a number of the most in depth instructional offerings of the firms we reviewed.

Set yet another way, owning a basket of securities through a fund lowers the "for every challenge" risk that will come with owning just one security.

Some would argue that by simply proudly owning a managed product, like a mutual fund or an exchange-traded fund, an Trader by now has reached some amount of diversification. And that’s genuine: Because mutual funds and ETFs are made up of baskets of stocks, bonds, or some blend thereof, they provide additional diversification than owning one stock or a single bond.

With dollar-Charge averaging, you commit money often into a specified portfolio of securities. Working with this method, you'll get more shares when selling prices are reduced and much less when costs are superior.

With your wealth at stake, you could under no circumstances be too careful when choosing an advisor. The above mentioned solutions will help.

Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Julia Stiles Then & Now!

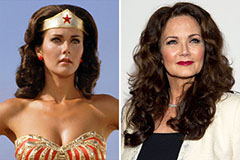

Julia Stiles Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!